For Carrying Cash" width="" height="" />

For Carrying Cash" width="" height="" /> For Carrying Cash" width="" height="" />

For Carrying Cash" width="" height="" />

The NRI Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 22 October 2023.

With the number of Indians travelling abroad at its highest level, many of us will have to decide how much cash to carry on our international flights. Even though it is safer to carry money as a credit or debit card, there are some situations where we have to keep some currency notes for our day-to-day expenses.

There are specific guidelines by the Reserve Bank of India (RBI) on the maximum limit of cash that can be carried through Indian airports by travellers including residents, NRIs and foreign tourists.

This article explains the Indian Customs rules for carrying cash as well as the cash limit allowed at Indian airports (Indian Rupees and Foreign Currency) while travelling to and from India.

According to the Central Board of Direct Taxes and Customs (CBDTC) guidelines, a resident of India who is returning from a visit abroad is allowed to bring in or take out Indian currency up to Rs 25,000.

NOTE: A person coming to India from Nepal or Bhutan may bring Indian currency notes only in denominations not exceeding Rs 100 (which means currency notes of Rs 200, Rs 500 and Rs 2,000 are not allowed).

According to CBDTC, any person (Resident, NRI or Tourist) can bring into India, from a place outside India, foreign currencies without any limit (subject to declaration limit).

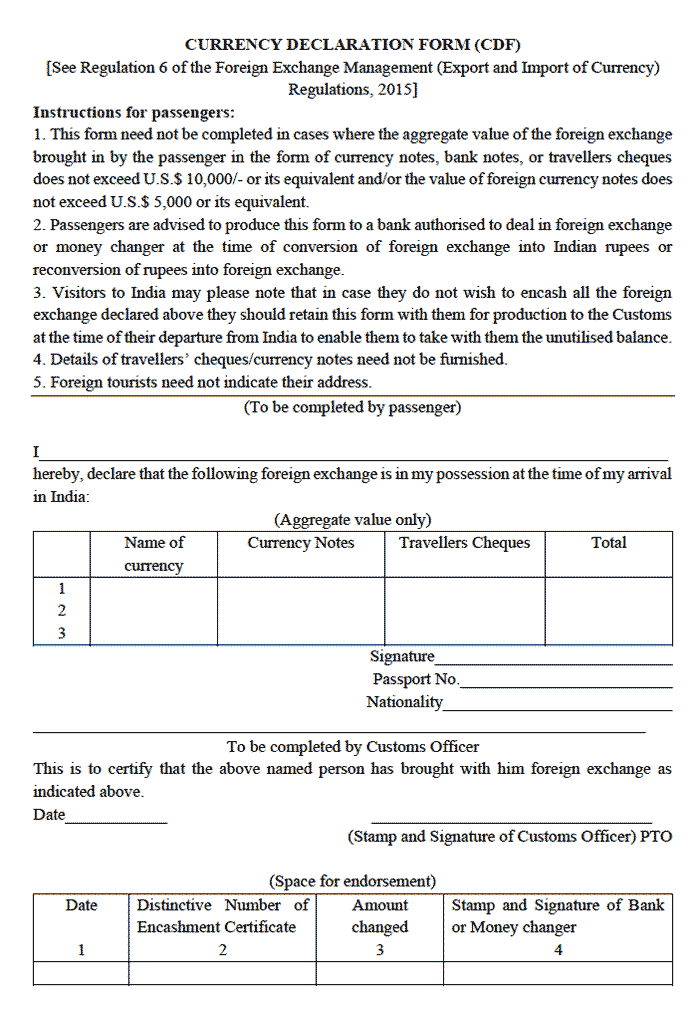

In case a visitor to India does not wish to encash all the foreign exchange declared on arrival they should retain the Currency Declaration Form with them for production to Indian Customs at the time of their departure from India to enable them to take with them the unutilised balance.

No declaration is required for bringing in foreign exchange/currency not exceeding US$ 5,000 in currency notes or its equivalent. This is also applicable to foreign exchange in the form of currency notes, bank notes or traveller’s cheques not greater than US$ 10,000 or its equivalent.

Generally, tourists can take out of India with them at the time of their departure foreign exchange/ currency not exceeding the above amount.

There is no specific limit on the amount of cash that can be carried on a domestic flight in India. However, you are responsible for providing a valid reason and source (with proof) for carrying cash of more than INR 200,000 (Rupees 2 lakhs).

Please note that income tax laws in India prohibit any cash transaction exceeding INR 200,000. Recently, there have been incidents of domestic travellers being caught with cash exceeding this limit.

An NRI coming into India from abroad can bring foreign exchange without any limit.

In case, the total value of foreign currency notes, traveller’s cheques, etc. exceeds US$ 10,000 or its equivalent and/ or the value of foreign currency exceeds US$ 5,000 in currency notes or its equivalent, it should be declared to the Customs Authorities at the Airport in the Currency Declaration Form, on arrival in India.

To meet medical treatment expenses outside India, you can purchase foreign currency self-certification for up to US$ 50,000. Banks may also release exchanges for amounts above US$ 50,000 if they receive estimates from doctors or hospitals in India or overseas.

Also, foreign exchange of up to US$ 25,000 is available for the patient and accompanying attendant on self-certification in order to meet boarding/lodging/travel costs.

The maximum amount of foreign exchange you can buy per academic year is US$ 30,000 or the estimate from the institution abroad, whichever is higher. There must be documentary evidence indicating the requirement.

There is no limit on the foreign currency that you can carry to India. However, you need to file a declaration if the currency value exceeds USD 5,000 or the total foreign exchange exceeds USD 10,000.

When going abroad, Indian residents, NRIs or Foreigners (except citizens of Pakistan and Bangladesh) are allowed to carry Indian currency notes of up to Rs 25,000.

There is no tax on the foreign currency you are importing to India. You just need to file a declaration if the currency value is above USD 5,000 or foreign exchange is above USD 10,000.

Copyright © NRIGuides.com – Unauthorized reproduction of this article in any language is prohibited. The information provided on this website is intended for general guidance and informational purposes only. It should not be considered a substitute for professional advice, and travellers are encouraged to verify visa requirements and travel advisories through official government sources before making any travel arrangements.

Aneesh, the Founder & Editor of DG Pixels, holds a Master’s Degree in Communication & Journalism, and has two decades of experience living in the Middle East. Since 2014, he and his team have been sharing helpful content on travel, visa rules, and expatriate affairs.

Share This With Someone Who Needs Itcan we carry currency to India from London should we pay if its 50000 pounds

Bhandari Lal SharmaHello sir,

One of my friend from UK came to India who was carrying a demand draft of worth 50000 dollars. The flight landed on 07-09-2023. The customs people Firstly contacted me to inform the arrival. At the same time the demand from me Rupees 49900/- to allow her to enter to India. After that the customs lady again call me telling that she is carring DD of worth

foreign currency of 50000/- the value of which is approx Rupees 47,00,000/-.

Again customs lady demand from 99000/- assured me that they will allow to the UK visitor to India.

At the same time she assured me that after said amount is paid, they will allow the UK visitor to enter to India. As a courtesy I paid RS. 49900.00+99000.00+ 15000.00 (one day lounge charges at Mumbai international Airport) = total Rupees 163900.00 .

The interesting thing is that the account details on which they asked payment from me, belong to a lady Sabita Das’s personal account number :-

((Account name: Sabita Das

Account number: 0259104000260466

Ifsc code: IBKL0000259

pan: HZDPD0528M

address: barddhaman

Idbi bank.))

Now custom lady Pooja call me and told me that the visitor has not produced Income Tax clearance certificate, for which if you Rupees 1,75,000/- , we release the visitor.

Since I had transferred the huge ammount, I refused to customs lady that I am not able to make the payment as you are charging with us. I ask the customs lady to send the visitor back to UK. It is a talk of 08-09-2023.

Now I donot know whether they had returned the visitor back to UK, as vistor has Neither access to Mumbai international Airport to talk or chat on WhatsApp Nor Customs lady picking my phone call.

I humbly request you to explain me please what is happening? Is it fair with the foreign visitors who are our welcomed guests.

What the customs rule says??

Please guide me regarding this situation.

Can I get back my Amount paid to Mumbai international Airport customs people PERSONAL ACCOUNT?

2ND WHAT WILL HAPPEN WITH VISITOR?

KINDLY GUIDE ME

Thanks & regards

Hi

I am travelling to India by next week from UK, I have saved as cash some INR2000 denominations, I have more than 2 lakhs with me, None of the FOREX is accepting the denominations due to recent announcements of withdrawal of Rs 2000. Will it is ok to carry to India to deposit in India bank accounts?

Other question to you is ,I understand only Rs25000 is allowed to carry according to Customs Rule to India by NRI’s.

In this case, I shall declare Indian rupees and take as much I can?

I appreciate your response.

Thanks

Gobinath S

Officially , you are allowed to bring in only Rs.25000 per person. But many travellers have told me that because of withdrawal of Rs.2000 note & that RBI has made no arrangement for people who have these notes & are living overseas, the customs at Indian airports are generally relaxed about this issue. But if you declare them, you may have a problem.

soumitra choudhuryI shall be travelling to Nepal. Credit/Debit cards issued to us in India are not permissible for use in Nepal and Bhutan as specifically mentioned on cards. I understand I can carry a maximum of Rs.25000/- in Indian currency. How then am I supposed to meet my expenses in Nepal if they exceed Rs.25000/- ??

My question is filing declaration above $5K and total 10K monitory policy is for per person , or per adult person or per family?

If an NRI coming to India with Family

Say husband & wife, 3 kids (5 year, 9 year & 13 year)

Can we carry maximum of 5K * 5 =25K

or

5K * 2 =10k

or

5K

If foreigner comes india with DD more then 20k us doller so any charge will taken for FRRO certificate like 1.2 lakh approx and then for police verification they are asking 75 thousand and all this money they want in indian rupees so please someone reply that is this a rule in india ? And how will the person from other country will arrange it in indian currency

If foreigner comes india with DD more then 20k us doller so any charge will taken for FRRO certificate like 1.2 lakh approx and then for police verification they are asking 75 thousand and all this money they want in indian rupees so please someone reply that is this a rule in india ? And how will the person from other country will arrange it in indian currency

If foreigner comes india with DD chq and it is more than 10k us$ so is there taken charge for FRO certificate as amount 1.2 lakh and then for police verification approx 1 lakh rupees and all money they want in indian rupees . Pls someone answer it ,is it a rule here in india ? And if yes so how will the foreign person will arrange it the changes money in indian rupee pls some one reply its urgent

Biplab Kumar BiswasI am first time in foreign. Now I’m in Gabon. How much can I carry US$ while returning to India.

CharanPls i need answer..

If a person from London bringing 300000 ponds bringing through demand draft.. what is the proper procedure in Indian any airport??

I also want the ans for same question only difference in currency about 40k dollar ,if some one give answer you then please send answer me also because my 2 lakh cash was invested in this and then after they are not releasing that person and they want more 75 thousand rupees for police verification so please give me answer if someone vive you answer